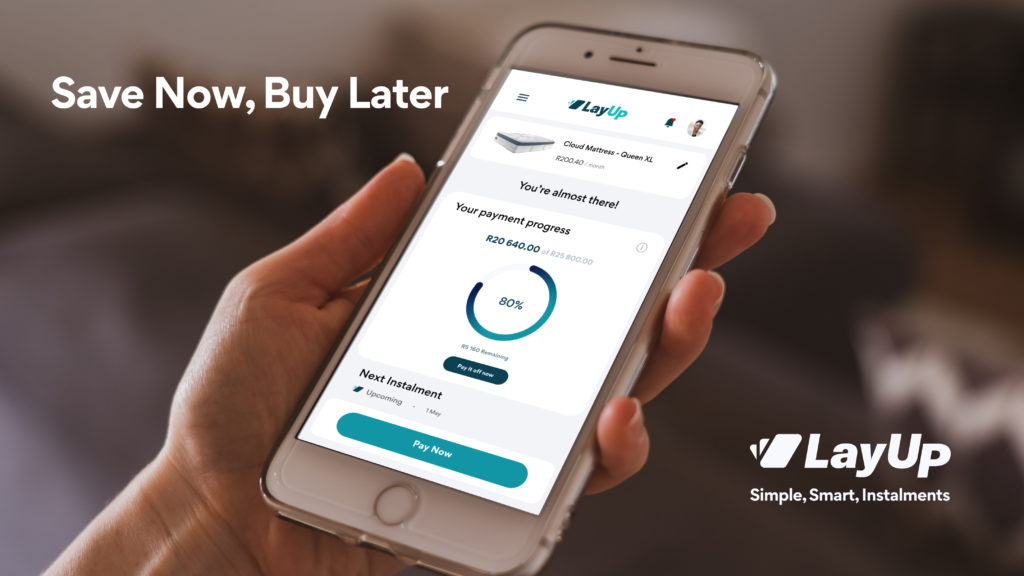

LayUp Technologies, an advanced recurring payments system provider, is flipping the script on credit and is providing South Africans with an innovative save now buy later solution. In doing so, the company is reinforcing its commitment to driving financial inclusion across the continent through cloud-based pre-payment technology.

“I founded LayUp Technologies in 2018 as an alternative, first of its kind, business-to-business and business-to-consumer payments company. Its aim has always been to disrupt the financial service industry by enabling millions of people who are locked out of the economy to access interest-free ways to pay in parts over-time. LayUp has identified massive untapped opportunities in pre-payment methods that do not require a credit check or put the end-consumer at risk of late fees or interest. By digitising analogue payment methods like lay-by, subscriptions, and recurring billing, we aim to give previously invisible consumers a way to access the economy,” says Andrew Katzwinkel, CEO and founder of LayUp Technologies.

At a time when inflation in South Africa has hit record levels, ongoing concerns around the energy crisis, and the continually increasing fuel price, LayUp Technologies is positioning itself as a recurring payment system that provides an alternative to credit.

“Credit is becoming an increasingly ugly term. Within the next two years, those who are highly indebted will face a world of pain with the threat of a recession looming. LayUp Technologies has been working closely with strategic partners like Dial-a-bed, Union Tiles, and others to help empower a consumer base that has historically been underserved and virtually invisible to traditional financial institutions,” says Katzwinkel.

Because LayUp Technologies focuses on the pre-payment market, it does not have to be a financial services provider and customers do not have to undergo credit checks. Furthermore, because it is the customer who saves a pre-selected monthly amount to make a purchase, there are no penalty fees for late payments. These pre-payment solutions deliver an easily accessible payment vehicle where any person regardless of whether they have a bank account or not, can save for virtually any item over a specified period.

According to some estimates, almost 24% of South Africans are out of the system with R12 billion in cash is believed to be held outside of banks.

“The pre-payment market is therefore massive with significant potential for growth. In addition to digital lay-by services for in-store and online merchants, we can also provide subscription and recurring billing services for businesses. These can include online gym classes, e-learning, and other innovations where people do not have to go through any credit checks. It is a pay now, get now environment. It also provides great opportunities for recurring billing which makes it ideal for funeral homes looking to provide customers with such a payment option,” adds Katzwinkel.

For SMEs and micro-businesses, LayUp Technologies delivers a plug-and-play solution without the need to hire a developer or spend much-needed funds to integrate with existing systems. It is as easy as downloading the app and getting up and running overnight. And for merchants, the app can be installed on a range of point-of-sale terminals that the store can use to offer customers any payment plan that fits their budget.

“LayUp Technologies is not just an e-commerce lay-by start-up anymore. We have grown into a fully-fledged recurring payment system that offers advanced pre-payment technology for businesses,” concludes Katzwinkel.